The Facts About Paul B Insurance Revealed

Wiki Article

How Paul B Insurance can Save You Time, Stress, and Money.

Table of ContentsNot known Details About Paul B Insurance Some Known Questions About Paul B Insurance.Fascination About Paul B InsurancePaul B Insurance Can Be Fun For Anyone3 Simple Techniques For Paul B Insurance

The idea is that the cash paid out in cases with time will certainly be less than the overall costs gathered. You may seem like you're throwing cash gone if you never sue, but having item of mind that you're covered in case you do experience a considerable loss, can be worth its weight in gold.Picture you pay $500 a year to guarantee your $200,000 house. You have 10 years of paying, as well as you have actually made no insurance claims. That comes out to $500 times one decade. This indicates you have actually paid $5,000 for residence insurance coverage. You start to question why you are paying a lot for absolutely nothing.

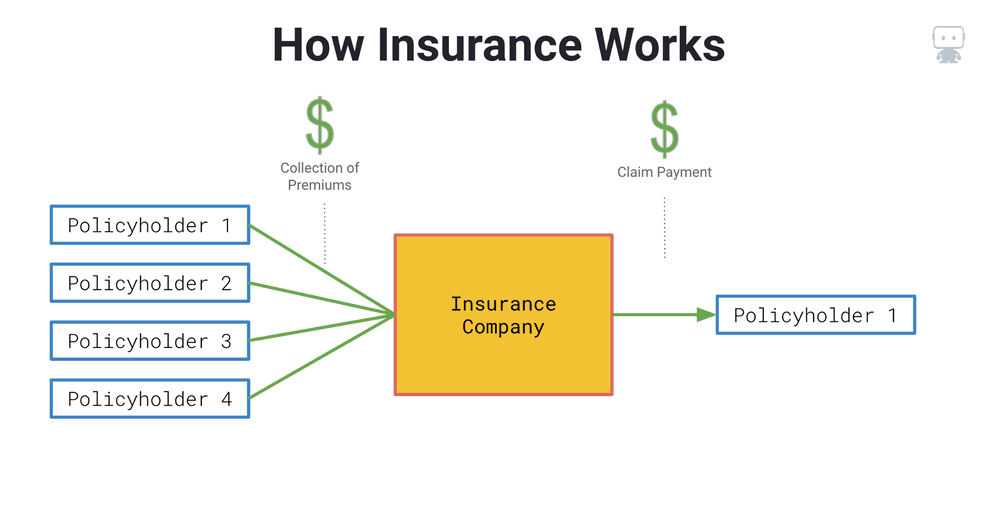

Due to the fact that insurance is based on spreading the danger amongst many individuals, it is the pooled cash of all individuals paying for it that permits the firm to develop assets as well as cover cases when they happen. Insurance policy is a business. It would be great for the firms to just leave rates at the exact same level all the time, the fact is that they have to make enough money to cover all the prospective cases their policyholders may make.

See This Report on Paul B Insurance

Underwriting modifications and rate rises or declines are based on outcomes the insurance policy firm had in past years. They sell insurance from just one firm.The frontline individuals you deal with when you purchase your insurance policy are the agents and also brokers who stand for the insurance policy business. They an acquainted with that company's items or offerings, yet can not speak in the direction of other business' policies, prices, or item offerings.

Not known Facts About Paul B Insurance

The insurance coverage you require varies based on where you are at in your life, what sort of properties you have, and also what your long-term objectives and tasks are. That's why it is vital to make the effort to discuss what you want out of your plan with your representative.If you take out a car loan to get an automobile, and get more afterwards something happens to the auto, space insurance coverage will settle any type of part of your car loan that standard car insurance does not cover. Some lending institutions require their customers to carry gap insurance coverage.

The 20-Second Trick For Paul B Insurance

Life insurance covers the life of the guaranteed individual. Term life insurance covers you for a period of time picked at acquisition, such as 10, 20 or 30 years.If you don't pass away throughout that time, no one earns money. Term life is preferred because it provides big payments at a reduced cost than permanent life. It also provides coverage for an established number of years. There are some variants of regular term life insurance coverage plans. Exchangeable plans allow you to convert them to permanent life plans at a greater premium, permitting longer as well as possibly extra adaptable protection.

Permanent life insurance policies construct cash money worth as they age. A section of the premium settlements is contributed to the money worth, which can gain rate of interest. The money worth of entire life insurance policy plans expands at a fixed rate, find this while the cash value within global plans can rise and fall. You can make use of the cash money value of your life insurance coverage while you're still active.

Getting The Paul B Insurance To Work

$500,000 of entire life insurance coverage for a healthy and balanced 30-year-old female prices around $4,015 every year, on standard. That exact same level of coverage with a 20-year term life plan would certainly cost a standard of concerning $188 every year, according to Quotacy, a broker agent company.Variable life is an additional permanent life insurance click this link coverage choice. It's a different to entire life with a set payment.

Below are some life insurance policy fundamentals to assist you better comprehend how protection functions. For term life plans, these cover the cost of your insurance as well as administrative prices.

Report this wiki page